MANCHESTER -- An assistant U.S. bankruptcy trustee is moving to block a reorganization plan for The Golf Club of New England saying there are too many unanswered questions, such as why club officers don't know how $14.5 million was spent.

The plan calls for transfer of the club's assets to Soft Draw, Investments, LLC, an entity controlled by Governor Craig Benson, a co-founder of Cabletron, who is believed to have a personal worth of hundreds of millions of dollars.

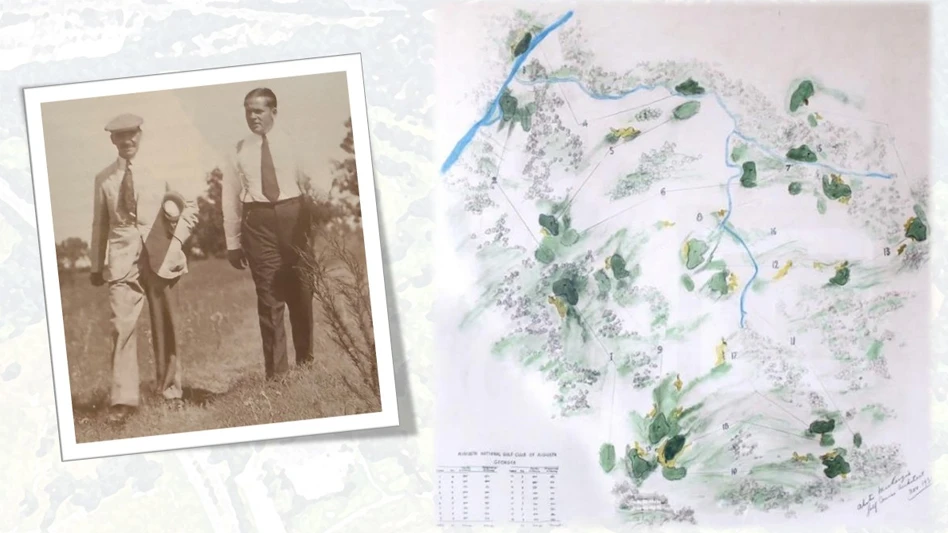

Soft Draw, the largest creditor, is owed nearly $17 million lent to finance construction of the exclusive Arnold Palmer-designed golf course and a turn-of-the-century style stone clubhouse overlooking the rolling grounds.

An appraiser hired by the golf club estimates its fair market value at $12.4 million.

Assistant U.S. Trustee Geraldine B. Karonis, in papers filed in U.S. Bankruptcy Court this week, said it appears the golf course is transferring to Soft Draw the rights to take legal action to recover lost funds.

She faults the golf course plan for not putting a dollar value on any fraudulent-conveyance lawsuits, usually considered an asset in bankruptcies.

Karonis questions whether the right to sue shouldn't belong to the creditors and club members who might be able to recover some of their losses -- in light of the fact that $25 million was reported spent on a facility now assessed at less than half that.

"The failure to disclose the types of such actions, and the parties against whom such actions may exist, . . . is not appropriate," Karonis wrote.

Peter Tamposi, attorney for the debtor, said the final version of the plan is subject to negotiation.

"We are making an opening offer with the disclosure statement, and then it will be commented on," Tamposi said. "We will accommodate some of those objections and not others. We do not see any objections that cannot be overcome or addressed satisfactorily."

Concerns about the reorganization will be aired at a Thursday hearing in bankruptcy court.

A leasing company is objecting because the plan doesn't address how the club will pay its overdue and future bills.

CitiCapital Commercial Leasing says the club is in default on May and June lease payments for 50 golf carts and 14 utility vehicles.

Under the plan, Soft Draw would take over all assets and pay unsecured creditors 25 cents on the dollar on their claims, or roughly $63,000. The governor's company would pay the legal and accounting expenses for the bankruptcy.

It will pay over $258,000 in property taxes owed to Greenland and Stratham. And, it will also pay whatever portion the court requires on the $600,000 owed to Channel Building Co., which holds a mechanic's lien on the clubhouse.

All creditors will eventually vote on a final disclosure plan.

Tamposi said the debtor golf course won't be pursuing lawsuits to recover any improper expenditures or diversions of funds. "We had a forensic accountant look at it, but it would be prohibitively expensive to go forward with a full audit," he said.

"We have isolated a couple of hundred thousand dollars in unusual transactions that we will describe in an amendment to the disclosure statement.

"We will be transferring to the lender (Soft Draw) the ability to pursue those claims, and I do anticipate the lender will choose to pursue them," Tamposi said.

Soft Draw's attorney, Bruce Harwood, could not be reached yesterday.

The "millionaires golf club" founded by corporate CEOs filed for Chapter 11 bankruptcy protection on Feb. 19 after only one season. An original member was ex-Tyco chief L. Dennis Kozlowski, who is no longer associated with the club.

Most of the original directors split from the board once they saw it was headed for financial trouble.

The club was able to open for the summer due to additional loans from Soft Draw.

The attorney for Channel Builders is demanding disclosure of the financial strength of Soft Draw to ensure it can meet the obligations in the plan.

"The lender should be required to submit a certified balance sheet as well as financial projections and the source of any funding that will be needed for its operations," Channel's filing said.

"Though its owner (Benson) has the wherewithal to guaranty all obligations under the plan are met, the obligations are not guaranteed, so the financial strength of the lender standing alone is critical," wrote attorney Joseph A. Foster.

Source: The Union Leader (Manchester N.H.)

Latest from Golf Course Industry

- Tartan Talks 116: Doug Smith

- Audubon International adds 127 golf courses to Monarchs in the Rough

- USGA’s GAP preps for fourth year

- Protect your vehicles from rodent damage

- VIDEO: Fun with fairways

- From the publisher’s pen: Humble giving

- Syngenta adds two to western U.S. team

- The Aquatrols Company introduces soil surfactant for Canada